Integrated with RealMe® Identity Verification

Manage your entire AML compliance from one platform

Know your customer. Know you comply.

Taking the stress out of compliance.

Looking after Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) can sometimes feel like a trip to the dentist - painful and expensive.

But it doesn’t have to be.

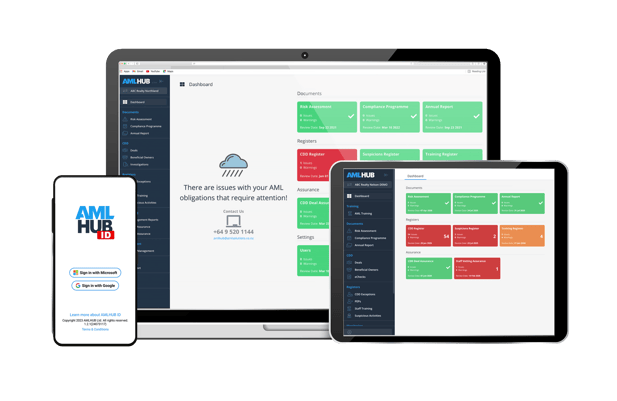

AMLHUB is New Zealand’s first AML platform - owned and operated right here in Aotearoa - that gives you visibility and control of your AML obligations in one place. With AMLHUB, you’ll achieve AML compliance, cut costs, reduce risk, and sleep better.

It’s a one-stop-shop for helping you manage your AML/CFT programme end-to-end. Compliance just got easier with an umbrella view of your tasks on a single cloud-based platform.

Run your AML/CFT compliance operation right here.

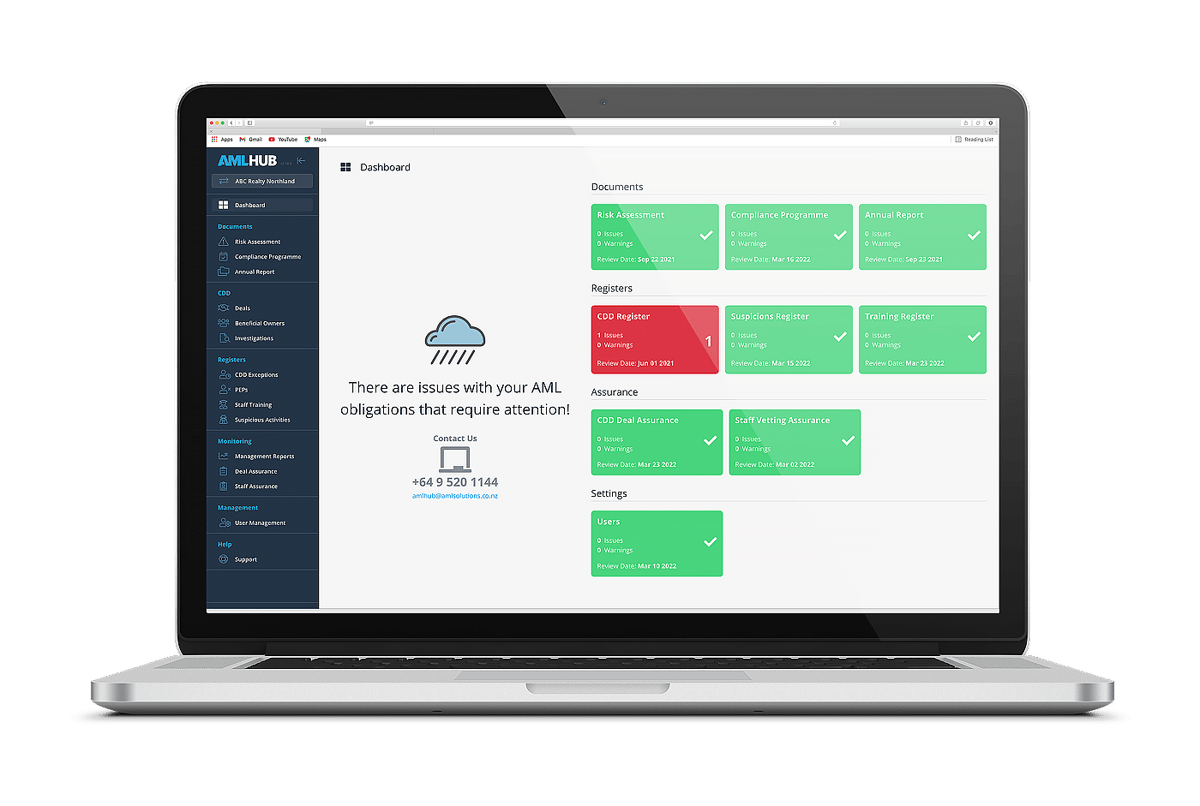

Organise and plan your entire AML compliance operation in one place.

AMLHUB is the only AML solution that gives you a complete overview of your AML tasks and control of your customer due diligence (CDD).

Our software enables you to record and keep track of your training obligations, transaction monitoring, document-keeping, and staff vetting, ensuring you’re on top of compliance now and in the future.

AMLHUB’s super-simple dashboard guides you through outstanding tasks and provides gentle reminders to keep you one step ahead.

Put your AML/CFT worries aside - compliance has never been so easy.

Solving compliance problems across different sectors.

Captured under AML legislation? We've got you covered with AML Software for Accountants.

With our help, you’ll save time, reduce costs, and drive efficiency and productivity. Our AML software for accountants allows you to easily manage your AML in-house, maximise compliance, and protect your clients. And your reputation.

The easy way to maintain confidence and compliance in your Law firm.

Managing AML/CFT with spreadsheets and paper documents is risky when it comes to protecting client data, and outsourcing the job to third parties leaves you with little oversight. With AMLHUB, you can safeguard your data and control your compliance obligations on one platform.

Record and manage client information the easy way with AMLHUB for financial services.

AMLHUB is the ideal solution for fund managers, finance companies, lenders, investment managers, and more.

With growing demands on financial services firms, getting compliance right is more important than ever. The cloud-based AMLHUB platform helps compliance officers meet their end-to-end AML financial services requirements with complete visibility.

A complete AML/CFT solution for Real Estate.

Real estate is one of the most competitive industries out there, and speed is everything. Fast onboarding of new clients is vital to give you the edge over your rivals and make the experience as pain-free as possible for sellers.

That’s where AMLHUB comes in. Our platform enables you to seamlessly control AML, improve efficiency, and streamline your sales process at a manageable cost.

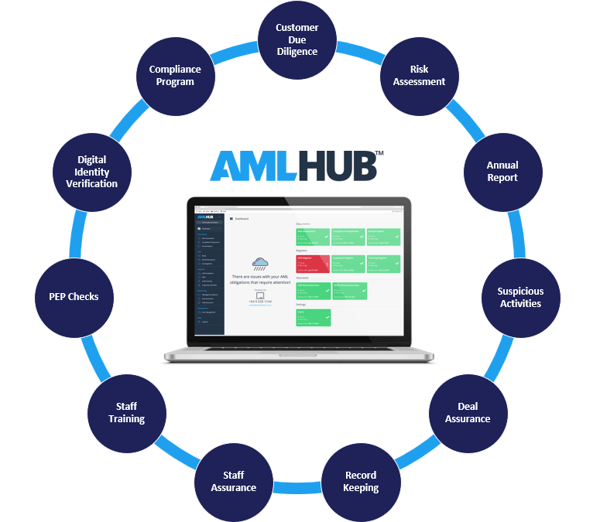

How AMLHUB works.

Think of us as your helpful digital AML assistant.

Our software takes the hassle out of your AML/CFT compliance, gathering all your key information in one place for you to manage.

Customer Due Diligence

Conduct simple, standard, enhanced, and ongoing CDD, and outsource to our team.

eIV tools

Onboard customers face-to-face or remotely using RealMe or electronic Identity Verification tools.

Document Management

Manage and update documents in one online location, leaving the perfect audit trail.

Assurance

Take a sample of the AML/CFT work you've done and check its been done correctly.

Suspicious Activities

Record any red flags to show your auditor that you are keeping an eye on things.

Training

Assign, manage, and record staff compliance training, and set yourself reminders when it is due.

Trusted by these companies and 10,000 users.

It's incredibly reassuring not having to handle every case ourselves.

"AMLHUB has proven time and again that they can manage even our trickiest clients with professionalism and ease."

We rely on AMLHUB's CDD Outsourcing service for all clients including a Company or Trust.

"Entrusting experts with the Enhanced CDD process not only ensures compliance and peace of mind, but also delivers excellent value for money."

We're really pleased with our new subscription to AMLHUB.

"As Compliance Officer I now feel more confident that we will be fully compliant at next audit. I also have more confidence that our documentation is well organised and easily reviewed. Reporting and audits are going to be much easier."

How has AMLHUB helped you manage your AML compliance programme?

"A God-send."

We love working with the AMLHUB and team.

"They have made managing my branch network a breeze and provide wonderful help and advice to help us get the job done. We see many technology providers in the market but none come close to the end-to-end solution offered by the AMLHUB. It continues to evolve with the industry and get better."

[AMLHUB] allows us to spend more time focused on our core business.

"The AMLHUB and mobile app has provided Barfoot & Thompson with a secure and reliable platform to assist us to meet and manage all our AML obligations. It has allowed us to streamline onboarding as well as the ability to efficiently monitor our large network of branches. The AMLHUB and the customer service team provide us with tremendous support, peace of mind, and allow us to spend more time focused on our core business."

AMLHUB increases the level of compliance and reduces overall compliance costs.

"It offers an end-to-end AML solution, from onboarding clients through to a comprehensive audit trail that helps meet a Reporting Entity's AML compliance needs."

We are extremely happy with how the HUB supports us and our company.

"As the AML Compliance Officer for 11 real estate offices, 120 salespeople, and 34 administration staff, having an AML platform able to handle our volume of work, is user-friendly, and assists me to ensure I am meeting our AML obligations easily and efficiently is mandatory. The AMLHUB provides all of those things and we are extremely happy with how AMLHUB supports us and our company."

AMLHUB integrates with RealMe® for secure ID verification

Verification is now easier than ever. Customers can use the RealMe® service to electronically verify the identity of customers who have a RealMe login and are RealMe® verified.

Send a quick email invite to your clients and they can verify their identity and address securely.

Why choose AMLHUB?

AMLHUB is the first AML platform in New Zealand to cater to your end-to-end AML obligations.

Designed by New Zealand’s leading AML experts, our platform has managed over 2,200 cases and transactions, onboarded more than 400,000 individuals and conducted transactions and cases worth over $200 billion.

We make your AML/CFT to-do list easy to manage by giving you the tools, knowledge, and support you need – just think of us as your virtual compliance officer.

You’ll sleep better knowing that, with AMLHUB, your compliance is being put first.